Renters Insurance in and around Cedar Rapids

Your renters insurance search is over, Cedar Rapids

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

- Cedar Rapids

- Linn County

- Fairfax

- Swisher

- Solon

- Ely

- North Liberty

- Mt Vernon

- Marion

- Walford

- Hiawatha

- Atkins

- Newhall

- Johnson County

Insure What You Own While You Lease A Home

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented condo or house, renters insurance can be one of those most reasonable things you can do to protect your personal items, including your tools, entertainment center, bicycle, smartphone, and more.

Your renters insurance search is over, Cedar Rapids

Your belongings say p-lease and thank you to renters insurance

State Farm Has Options For Your Renters Insurance Needs

Renting a home is the right decision for a lot of people, and so is protecting your belongings with insurance. In general, your landlord's insurance might cover repairs for damage to the structure of your rented home, but that won't help you replace your possessions. Renters insurance helps safeguard your personal possessions in case of the unexpected.

There's no better time than the present! Visit Chad Johnson's office today to discover the benefits of a State Farm renters policy.

Have More Questions About Renters Insurance?

Call Chad at (319) 365-2020 or visit our FAQ page.

Simple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

Tips for renting a storage unit

Tips for renting a storage unit

Tips for selecting a rental storage unit, packing personal possessions, insurance for storage and how do storage units work.

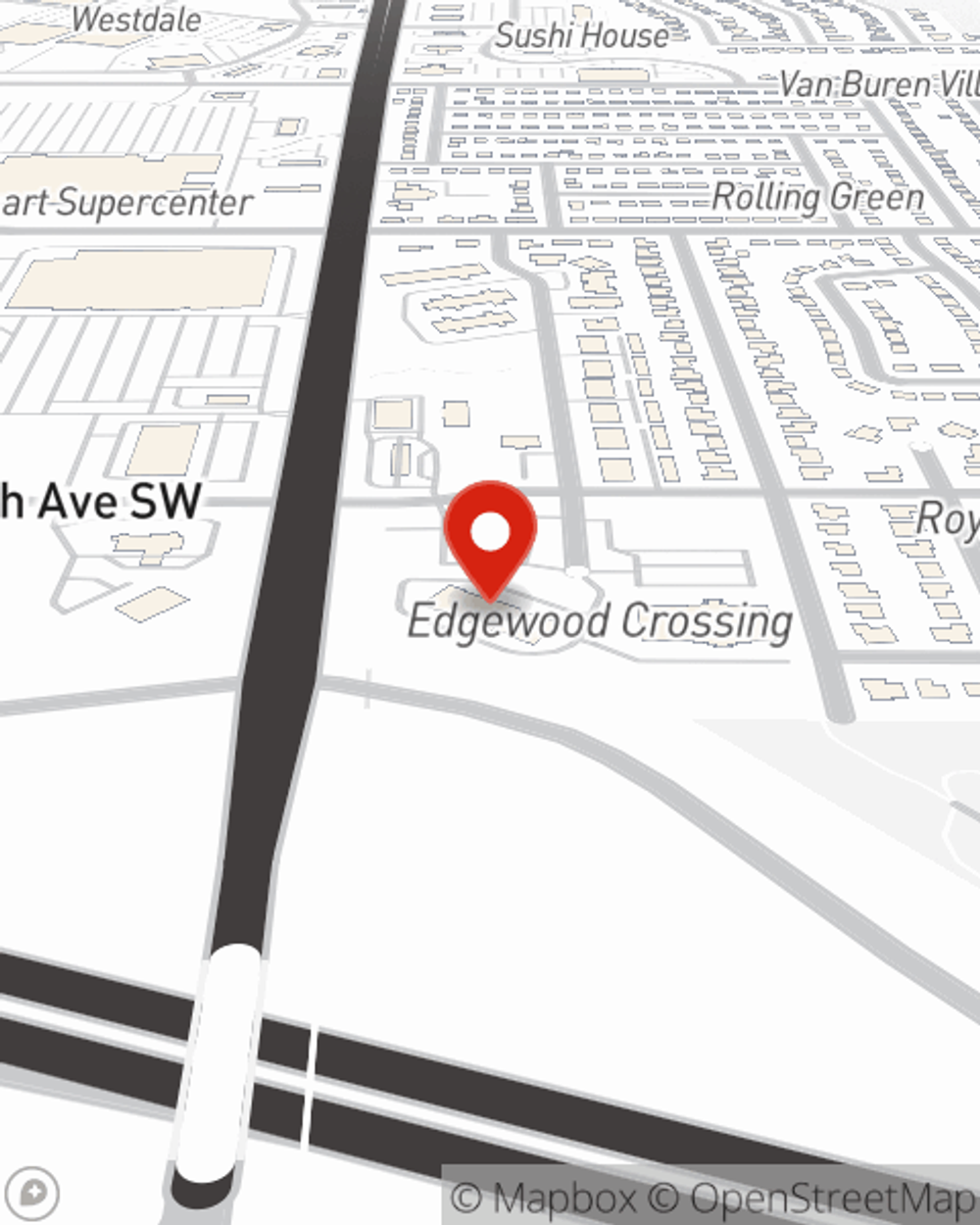

Chad Johnson

State Farm® Insurance AgentSimple Insights®

How do I know how much renters insurance to buy?

How do I know how much renters insurance to buy?

For renters insurance, finding the right balance means choosing accurate, appropriate limits for your personal property and liability coverage.

Tips for renting a storage unit

Tips for renting a storage unit

Tips for selecting a rental storage unit, packing personal possessions, insurance for storage and how do storage units work.